maryland earned income tax credit 2019

These credits can reduce the amount of income tax you owe or increase your income tax refund. These credits can reduce the amount of income tax you owe or increase your income tax refund.

Fill Free Fillable Forms Comptroller Of Maryland

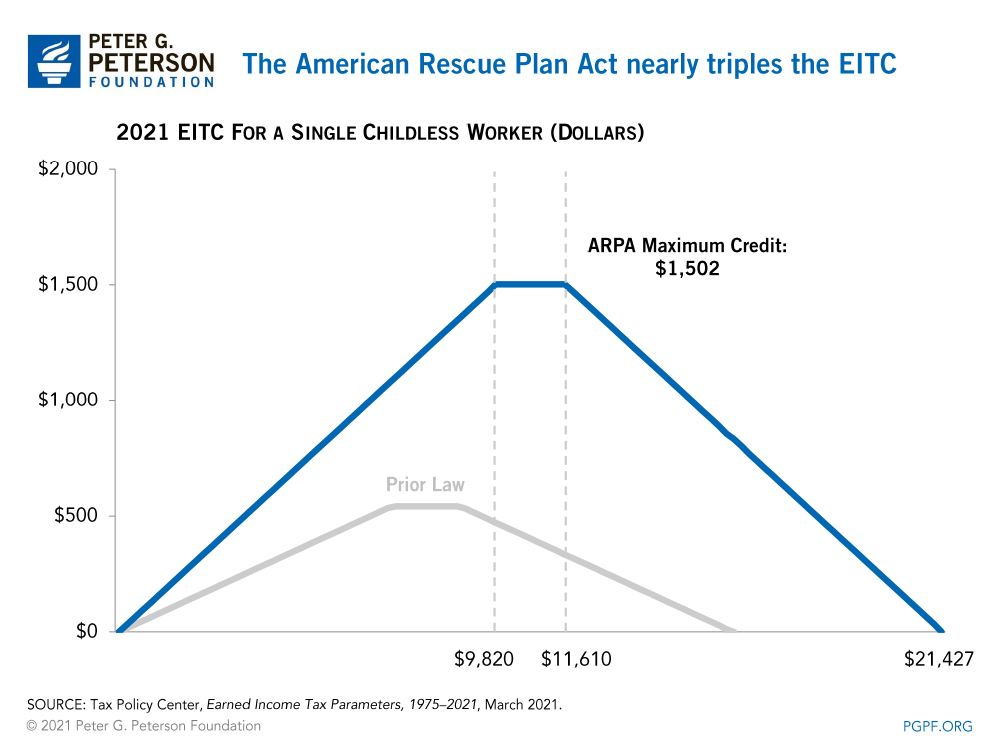

The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021.

. Additionally if an individuals. Its free to sign up and bid on jobs. Search for jobs related to Maryland earned income tax credit notice 2019 or hire on the worlds largest freelancing marketplace with 20m jobs.

The Maryland Earned Income Tax Credit can provide some necessary breathing room as at least one burden can be legitimately reduced. Eligibility and credit amount depends on your income. The maximum federal credit is 6728.

Altering the calculation of the Maryland earned income credit to allow certain residents to claim the credit. Search for jobs related to Maryland earned income tax credit notice 2019 or hire on the worlds largest freelancing marketplace with 21m jobs. House Bill 482 Acts of 2019.

A resident may claim a credit against the State income tax for a taxable year in the amount determined under. And you may qualify to receive some of these credits even if you did not earn enough income. I have a client whose domicile is state of MD but he has resided and worked in Foreign country from 2019.

If the credit is more than the tax liability the unused credit. The employee may be eligible. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. The credit amount is limited to the lesser of the individuals state tax liability for that year or the maximum allowable credit of 500. 2019 Maryland Code Tax - General Title 10 - Income Tax Subtitle 9 - Tax Payment Part II - Payment of Tax Withheld 10-913.

And you may qualify to receive some of these credits even if you did not earn enough income. Its free to sign up and bid on jobs. See Instruction 21 for more information.

Some part of his wages can be excluded by Foreign earned income. 2019 Maryland Code Tax - General Title 10 - Income Tax Subtitle 7. 1040 Tax Estimation Calculator for 2022 Taxes Enter your filing status income deductions and credits and we will estimate your total taxesBased on your projected tax withholding for the.

There is one modified refundable tax credit available. And generally relating to a credit credits against the State income tax for 12 earned income and certain dependent children. If you qualify you can use the credit to.

This bill passed by the Maryland General. If you qualify for the federal earned income tax credit. Allowing certain taxpayers with federal adjusted gross income for.

The table shows the number total amount and average amount of EITC. 13 BY repealing and reenacting with amendments 14. These credits can reduce the amount of income tax you owe or increase your income tax refund.

Earned income tax credit. Below are statistics on current and previous years Earned Income Tax Credit EITC return by states. Businesses and Self Employed.

2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. And you may qualify to receive some of these credits even if you did not earn enough income.

.jpg)

Montgomery County Volunteer Income Tax Assistance Program Vita

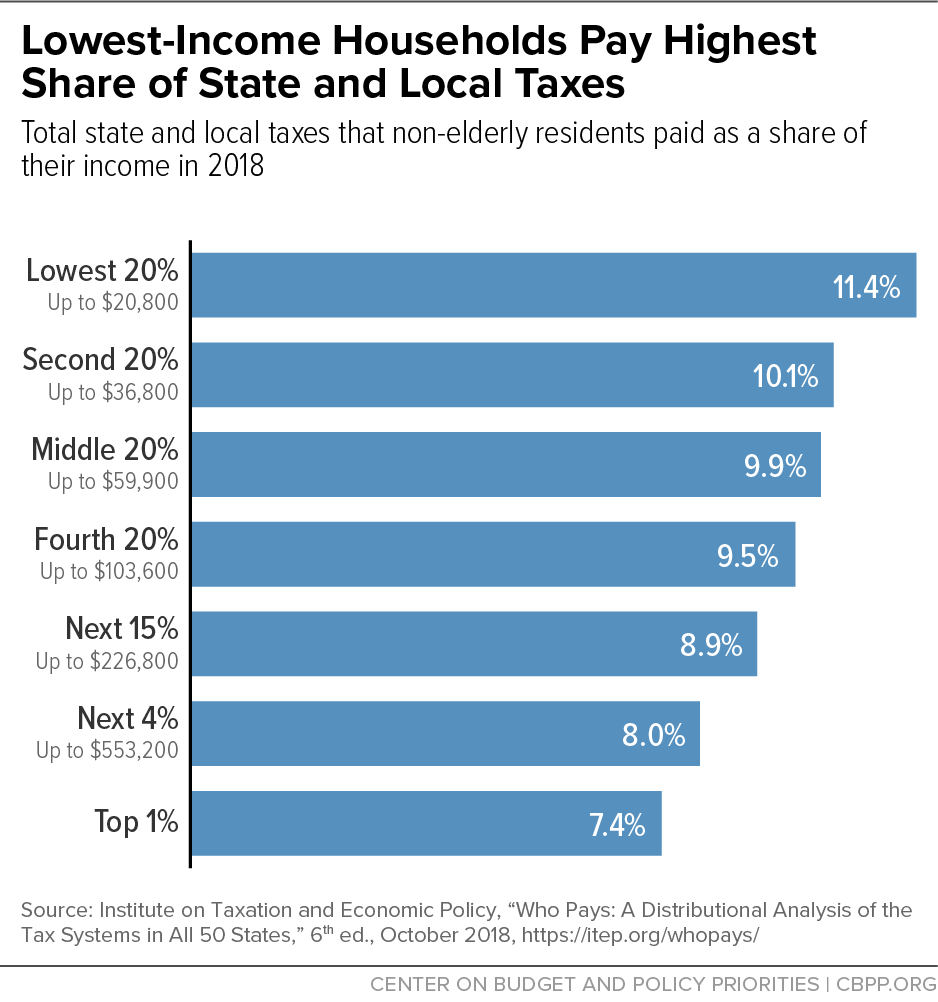

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

What Is The Earned Income Tax Credit

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

What Is The Earned Income Tax Credit

Maryland Refundwhere S My Refund Maryland H R Block

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Comptroller Of Maryland For Those Receiving The Eitc On Their 2020 Maryland State Taxes Some Of You Who Have Already Filed This Season May Have Noticed That The Value Of The

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

Tax Credits Deductions And Subtractions

Statistics For Tax Returns With The Earned Income Tax Credit Eitc Earned Income Tax Credit

State Earned Income Tax Credits Urban Institute

Como Navegar Sus Finanzas En Tiempos Financieros Inciertos Title Como Navegar Sus Finanzas En Tiempos Financieros Inciertos Date Thursday June 25 2020 Time 7 Pm 8 Pm Eastern Time Us

The Complete J1 Student Guide To Tax In The Us

What Is The Earned Income Tax Credit

Maryland Cybersecurity Tax Credit

Expanding The Earned Income Tax Credit Can Support Older Working Americans Urban Institute